Business Insurance in and around Portland

Looking for coverage for your business? Search no further than State Farm agent Amber Dean!

Almost 100 years of helping small businesses

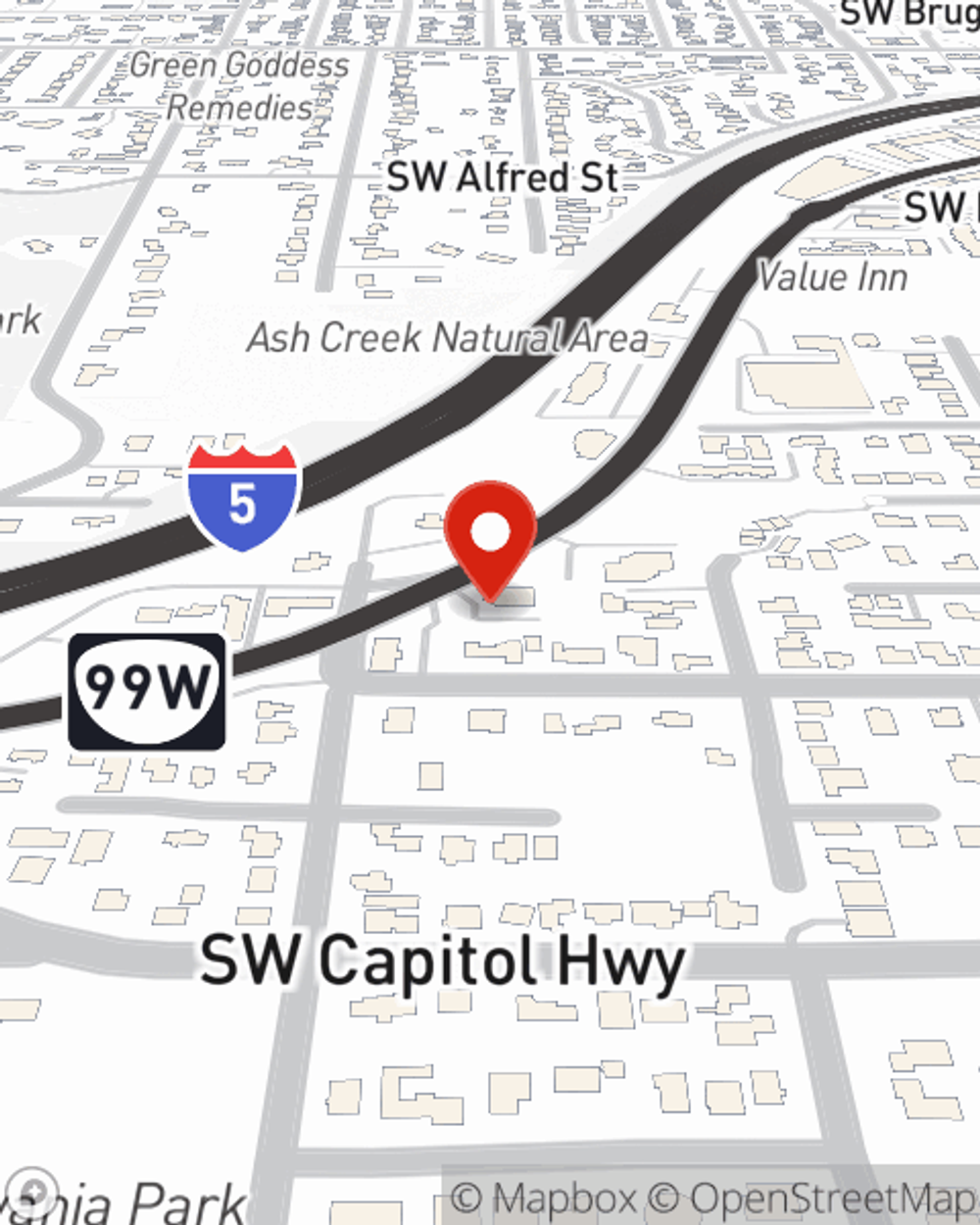

- Portland, OR

- Tigard, OR

- West Linn, OR

- Lake Oswego, OR

- Beaverton, OR

- Hillsboro, OR

- Tualatin, OR

- Joseph, OR

- La Grande, OR

- Pendelton, OR

- Enterprise, OR

- Wallowa, OR

- Aloha, OR

- Gresham, OR

- Gladstone, OR

- Milwaukie, OR

- Oak Grove, OR

- Cedar Hills, OR

Help Protect Your Business With State Farm.

Whether you own a a flower shop, a pharmacy, or a window treatment store, State Farm has small business coverage that can help. That way, amid all the various moving pieces and decisions, you can focus on your next steps.

Looking for coverage for your business? Search no further than State Farm agent Amber Dean!

Almost 100 years of helping small businesses

Get Down To Business With State Farm

When one is as passionate about their small business as you are, it makes sense to want to make sure all bases are covered. That's why State Farm has coverage options for worker’s compensation, commercial auto, artisan and service contractors, and more.

Since 1935, State Farm has helped small businesses manage risk. Contact agent Amber Dean's team to learn about the options specifically available to you!

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Amber Dean

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?